What is needs-based aid?

What Does “Meet 100% of Students’ Financial Need” Mean?

Did you know that +/- 75 of the top academic colleges in the USA, including the Ivies, do not offer merit or athletic scholarships? Instead, they pledge to “meet 100% of students’ financial need,” or they offer needs-based aid.

With average GPA’s of 4.0 +, SAT’s of around 1500, and acceptance rates of 1 – 5%, these universities aim to remove financial barriers by “ensuring that all admitted students, regardless of their financial background, can afford to attend”. At these institutions they pledge that getting in is the hard part, once you’re in they’ll make it affordable.

How Financial Need is Calculated for Needs-Based Aid

University Cost of Attendance – Expected Family Contribution = Your Need

Expected Family Contribution (EFC)

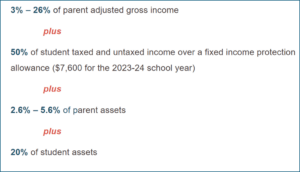

The first part of this needs-based aid process is calculating an “Expected Family Contribution” (EFC), or the amount the family is expected to pay yearly. It is generated through the FAFSA (federal) formula for U.S. citizens and the CSS Profile for international students, both of which require the submission of family tax returns. EFC is then calculated based on several formulas.

One such formula is:

Your Need

The university cost less the expected family contribution is classified as “the Student’s Need.” These institutions pledge to cover this needs-based aid through:

- Federal student loans (some institutions are ‘loan free’)

- State grants

- Work-study (on-campus work) – Students may work on campus for a maximum of 20 hours per week

- Institutional grants

Example:

For a U.S.-based student, if the university determines the family contribution to be $18,000 and the total cost to be $70,000, the $52,000 shortfall becomes the “Student’s Need.” The university will use needs-based aid, such as federal student loans, on-campus work, and institutional grants, to cover this need.

Important Information for International Students Looking for Needs-Based Aid

Key Points for International Students:

- As international students do not qualify for federal loans, at institutions that utilize federal loans their expected family contribution will be higher to factor this in. Institutions will not award a student a higher institutional grant to cover this lack of federal student loans.

- The EFC calculations determine the student’s/family’s need, a student/family does not determine their need. Even if you feel your expected family contribution is too high, this is the number the university will work with based on their calculations.

Some Universities that offer needs-based aid:

Click/select the university to visit their financial aid page.

Money.com – list of 75 colleges that offer needs-based aid

At BRUSA Sports, we understand the intricacies of financial aid policies. Our team will work closely with you to create a comprehensive list of schools tailored to your grades, career goals, and family finances. We guide you through the admissions process, helping you achieve your international student dreams.

To find out more please complete our evaluation form and we’ll be in touch!